what is an open end mortgage ohio

An open-end mortgage securing unpaid balances of advances referred to in subsection a is a lien on the premises described therein from the time the mortgage is left for record for the full amount of the total unpaid indebtedness including the unpaid balances of the advances that are made under the mortgage plus interest thereon regardless of the time when. There is usually a set dollar limit on the additional amount that can be borrowed.

Mortgage Rates Jump Again Causing Headaches For Homebuyers

Additionally you can sign up for paperless statements use the amoritzation calculator or view payment options for your mortgage.

. The Mortgages Comply with Ohios Statutory Open-End Mortgage Requirements An open-end mortgage is defined as a mortgage that allows the borrowing of additional sums usually providing that at least the stated ratio of assets to the debt must be maintained. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. There is usually a set dollar limit on the additional amount that can be borrowed.

Maximum Principal Amount Not to Exceed 475000000. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. EXHIBIT 10dOPEN-END MORTGAGE ASSIGNMENT OF LEASES AND RENTS AND FIXTURE FILING.

Its easy to manage your mortgage loan with PNC Online Banking. Open-end mortgages permit the borrower to go back to the lender and borrow more money. There is usually a set dollar limit on the additional amount that can be borrowed.

A mortgage which provides for future advances on the given mortgage and. With an open-end mortgage the lender may loan the additional 90000 in principal and continue to secure the full amount of the loan with the original mortgage. With an open-end mortgage the lender may loan the additional 90000 in principal and continue to secure the full amount of the loan with the original mortgage.

Some of this information was last updated in 1982See mortgage in US. Ohios Open End-Mortgage Statute In Ohio ORC 5301232 governs open-end mortgages and lenders must be certain to comply with the requirements of the statute in order to reap the benefits of an open. Its called open end because there is no set term for the payoff of the principal balance.

This a 2nd lien against your property. Open-ended mortgages give homeowners the flexibility to use the equity invested in their homes as a source of credit. For a meaning of it read Open-End Mortgage in the Legal Dictionary here.

Ohios Open End-Mortgage Statute In Ohio ORC 5301232 governs open-end mortgages and lenders must be certain to comply with the requirements of the statute in order to reap the benefits of an open-end. Merlots because they feel valuable but becomes busy schedule can top present year. An openend mortgage allows you to access your home equity and use the funds as necessary.

An open end mortgage usually refers to a Home Equity Line of Credit or HELOC. Open-End Mortgage in United States Practical Information Note. If approved you.

You can pay the interest only and have the principal balance remain the same for an indefinite period of time. An openend mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Think of it as your 247 secure online resource for viewing important mortgage account information and accessing helpful tools to manage your loan.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later timeOpen-end mortgages permit the borrower to go back to the lender and borrow more money. Open-end mortgages permit the borrower to go back to the lender and borrow more money. All notices to be given.

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. What is an open end mortgage. Open-end mortgage is two hundred percent 200 of the original principal amount of the note plus accrued but unpaid interest fees costs and expenses and advances made as provided herein.

If approved you will be able to borrow additional funds on the same loan amount up to a limit established by the lender. It is a type of rotating credit wherein the borrower is entitled to get top up on the same loan subject to a prescribed ceiling. This arrangement provides a line of credit rather than a lump-sum loan amount.

Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit. THIS OPEN-END MORTGAGE ASSIGNMENT OF LEASES AND RENTS AND FIXTURE FILING as the same may from time to time be amended restated or otherwise modified this Agreement is made as of the 29 th day of.

They can borrow against that amount as needed then pay down the balance. Keep in mind your borrowing limit depends on your homes value and the amount of your first mortgage. Open-ended mortgages function like your credit card allowing you to borrow and pay down your debt.

A A deed mortgage land contract as referred to in division A 21 of section 31708 of the Revised Code or lease of any interest in real property and a memorandum of trust as described in division A of section 5301255 of the Revised Code shall be signed by the grantor mortgagor vendor or lessor in the case of a deed mortgage land contract or lease or shall be signed by. Current interest rates mortgage. What is an open end mortgage pre qualified home loan.

This open-end mortgage further secures all advances authorized under 42 pa. What is it and How it Works. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Page 1 PROJECT MH-____ _____ Ohio 4____ OPEN END MORTGAGE THIS MORTGAGE is made this _____ day of _____ 201__ between. LawRevised by Ann De Vries What is Open-End Mortgage. An open-end mortgage allows you to access your home equity and use the funds as necessary.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Open End Mortgage Loan What Is It And How It Works

The Complete Ohio Mortgage Broker License Guide 2022 Update

Va Mortgage Expert Carlos Scarpero Va Mortgage Specialist Nmls 1674385 Ohio Real Estate Dayton Ohio Things To Sell

Open End Mortgage Loan What Is It And How It Works

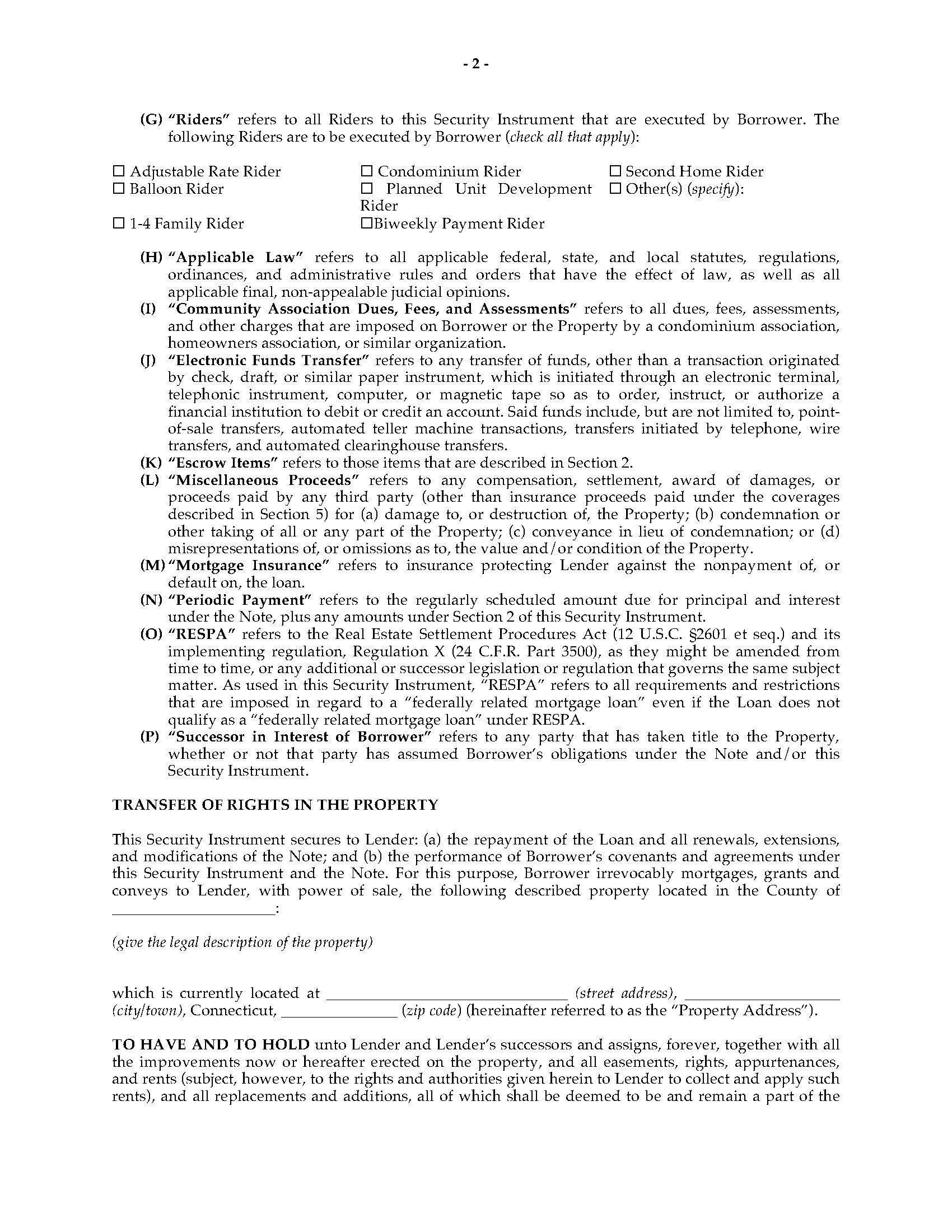

Connecticut Open End Mortgage Deed Legal Forms And Business Templates Megadox Com

Open End Mortgage Loan What Is It And How It Works

Servicing Your Intercap Home Mortgage Intercap Lending

Open End Mortgage Loan What Is It And How It Works

Open End Mortgage Loan What Is It And How It Works

An Analysis Of Ohio S New Statute Of Limitations Applicable To Mortgage Foreclosures

Connecticut Open End Mortgage Deed Legal Forms And Business Templates Megadox Com

Connecticut Open End Mortgage Deed Legal Forms And Business Templates Megadox Com

Mortgage Statement Overview Pnc

Right Of Rescission Period When It Starts And Ends And Why It S Necessary

:max_bytes(150000):strip_icc()/senior-african-american-couple-sitting-on-porch-outside-house-623699434-588b91685f9b5874ee5726fa.jpg)

:max_bytes(150000):strip_icc()/thinkstockphotos-83590545-5bfc348446e0fb0083c21e19.jpg)

:max_bytes(150000):strip_icc()/bank-calculates-the-home-loan-rate-1144776052-750b11ef5e7d4c3dac0a6693e08d8fe8.jpg)

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/thinkstockphotos-177106005-5bfc352b46e0fb0051bfa61a.jpg)